Ii a Justice of the Peace. Authentic Mens Gucci Caleido Sneaker.

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Joint.

. RM20 Stamp duty for 2 copies. RM10 Stamp duty for 1 copy only RM10 Stamp duty for 1 copy only RM20 Stamp duty for 2 copies RM20 Stamp duty for 2 copies RM20 Stamp duty for 2 copies RM20 Stamp duty for 2 copies Additional documents required for opening of LC. Generally it is easy to calculate stamp duty according to the rates provided by the Indian Stamp Act or the State.

The Scottish Government to have borrowing powers up to 5 billion. KUALA LUMPUR July 15 Prime Minister Datuk Seri Ismail Sabri Yaakob today announced a 100 per cent stamp duty exemption for first-time homeowners of properties priced RM500000 and below through the Keluarga Malaysia Home Ownership Initiative i-MILIKI initiative from June 1 2022 to December 2023. The Bank uses the Standardised Base Rate SBR as the reference rate to price all new retail loansfinancing facilities.

We service our clients with a well-qualified and experienced team close to 1000 staff led by over 100 Partners and Directors through our offices in Malaysia Brunei Cambodia Lao PDR Myanmar and. RM10 for Letter of Offer Commitment Fee. Or vii an officer of a company incorporated under any written laws carrying on the business of.

SEARCH NOW SAVE SEARCH. Happy Buying and Selling. The ability to raise or lower income tax by up to 10p in the pound.

Now here is some history about the RPGT. First it was suspended temporarily from April 2007 to December 2009 and reintroduced in 2010. A revenue stamp tax stamp duty stamp or fiscal stamp is a usually adhesive label used to collect taxes or fees on documents tobacco alcoholic drinks drugs and medicines playing cards hunting licenses firearm registration and many other thingsTypically businesses purchase the stamps from the government and attach them to taxed items as part of putting the items on.

The current Standardised Base Rate SBR starting from 1 August 2022 is 225 pa. Iv a Notary Public. The stamp duty is to be made by the purchaser or buyer and not the seller.

News on Japan Business News Opinion Sports Entertainment and More. A fixed stamp duty ranging between a minimum of LL 250 and a maximum of LL 2 million is applicable on documents in accordance with schedules appended to the. The basis and rates of premium differ between the respective states in Malaysia.

Agreements that are not made on Stamp Paper. Two kinds of stamp duties are levied. Section 35 of the Stamp Act makes a document which does not bear a requisite stamp duty as inadmissible in a court of law.

1 on the unutilized portion of the overdraft facility for amount above RM250000 Exit Fee. A within West Malaysia. In 2019 the RPGT rates have been revised.

The Act gave extra powers to the Scottish Parliament most notably. Stamp duty is a necessary evil for commercial property purchases. Section 4 Stamp Act 1949 SA 1949 Item 4 First Schedule Stamp Act 1949 SA 1949 Item 221b First Schedule Stamp Act 1949 SA 1949 TTDCSB V Pemungut Duti Setem.

Successful applicants will be eligible for 100 loan amount of the purchase price with an additional 5 of purchase price to finance for insurance MRTA. In 2014 the RPGT was increased for the fifth straight year since 2009. For full repayment of the outstanding ASB Financing made within the first 2 years from the date of loan disbursement an exit fee as penaltycompensation to the bank based on the difference between the ASB Board Rate and.

First-time homebuyer with a monthly gross income not exceeding RM5000 if single borrower or a monthly gross income not exceeding RM10000 if joint borrower family only Stamp duty. Like filling your car with fuel before a long trip stamp duty is a necessary evil when you buy a commercial property. Free shipping for many products.

Stamp duty exemption on instrument of agreement for a loan or financing in relation to a Micro Financing. Based on the revised guidelines issued by the IRBs Stamp Duty Unit on 23 June 2020 effective 1 March 2020 the value of shares transferred for stamp duty purposes is the value of the net tangible assets or actual sale consideration whichever is higher. Feel free to use our calculators below.

Founded in 1964 BDO Malaysia has more than 50 years of experience in Malaysias commercial landscape with a strong reputation as a top quality professional services provider. The calculation of the additional premium is based on the State Land Rules. Any change is applied across all tax bands.

The only discrepancy of an unstamped agreement is producing an unstamped agreement in court as evidence. Iii a Land Administrator. However actual sale consideration will be used for transfers of shares in newly incorporated companies or.

Vi an Advocate and Solicitor. Then theres another revision to the RPGT under Budget 2020 as well as the Exemption Order. 100 bank loan with T.

Find almost anything for sale in Malaysia on Mudahmy Malaysias largest marketplace. Search title only Show only URGENT. It acts as the central point of reference for research and data.

A proportionate stamp duty of 04 is levied on all deeds and contracts written or implied that mention specific payments or other sums of money. Devolving stamp duty and landfill tax to Scotland to replace them with new taxes specific to Scotland. However this provision has certain exceptions and does not completely.

Find many great new used options and get the best deals for Canada Stamps Collection Scott24 Victoria F-VF No Gum at the best online prices at eBay. Delay in payment of stamp duty can make the individual liable to pay a fine ranging from 2 to 200 of the total payable amount. Stamp duty exemption on loanfinancing agreements executed from 1 January 2022 to 31 December 2026 between MSMEs and investors for funds raised on a peer-to-peer P2P platform registered and recognised by the Securities Commission Malaysia.

A valuation of the land is required because the law requires an additional premium to be paid when an application for a change in category of land use express condition is approved. Malaysia is the central coordinating agency CCA under the Ministry of Entrepreneur Development and Cooperatives MEDAC that coordinates the implementation of development programmes for small and medium enterprises SMEs across all related Ministries and agencies. BSN bank will provide a loan of up to RM500000 with financing tenure up to 35 years for married youths who are first-time The government will also give 50 of stamp duty exemption for the loan agreement.

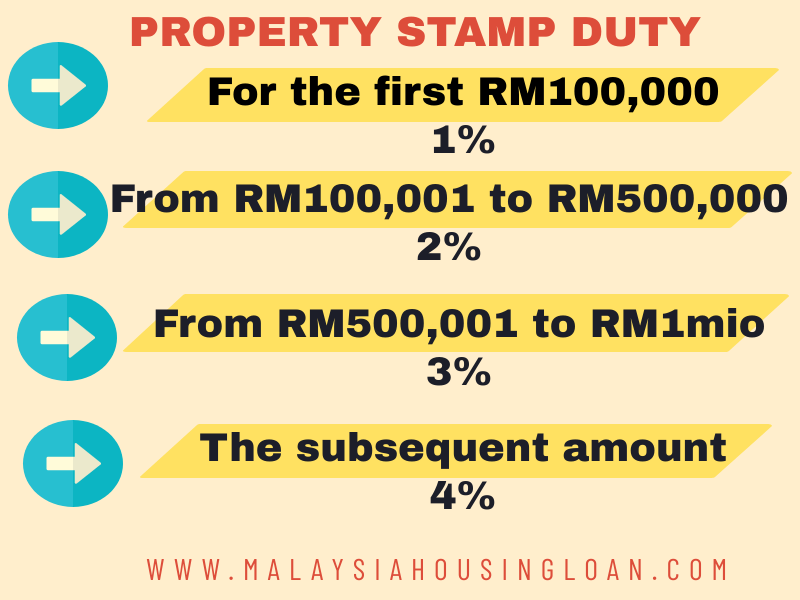

The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan agreements dated 1 January 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 July or later. Erin Delahunty 23 AUGUST 2019. Case Report Appeal pursuant to Section 4 Item 4 First Schedule and Item 22 First Schedule of the Stamp Act 1949.

The amount you pay is calculated on a sliding scale generally from 1 to 6 of the. V a Commissioner for Oaths. SME Corporation Malaysia SME Corp.

Its an annoying expensive requirement that cant be avoided.

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Memorandum Of Transfer Mot And 4 Important Documents In Malaysia

Property Transfer By Way Of Love And Affection Publication By Hhq Law Firm In Kl Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Exemption Under I Miliki Announced By The Prime Minister On 15th July 2022 Publication By Hhq Law Firm In Kl Malaysia

The 2019 Stamp Duty Exemption Property Insight Malaysia Facebook

Step By Step Guide To Create A Social Media Campaign Social Media Social Media Marketing Courses Marketing Strategy Social Media

How To Transfer Property Ownership Between Family Members In Malaysia Propsocial

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Upfront Costs Of Purchasing A Home In Malaysia Propsocial

Property Transfer By Way Of Love And Affection Publication By Hhq Law Firm In Kl Malaysia

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Bandarrimbayu Real Estates Design Property Design Real Estate Marketing

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan